The tax applies to vehicles having a taxable gross weight of 55,000 pounds or more. Report the tax on Form 2290, Heavy Highway Vehicle Use Tax Return. This section identifies some of the excise taxes you may have to pay and the forms you have to file if you do any of the following.

What are small business expenses?

In addition, all payments made to freelancers, contractors, or other non- employees qualify as tax write-offs as well. Be sure to send a 1099-NEC form to any non-employee whom you pay $600 or more per year by the January https://modaswilson.es/sage-intacct-review-the-best-cloud-accounting/ 31 st filing deadline. As with office supplies, the software and electronics you use for your business are also tax write-offs.

Best practices for managing small business expenses

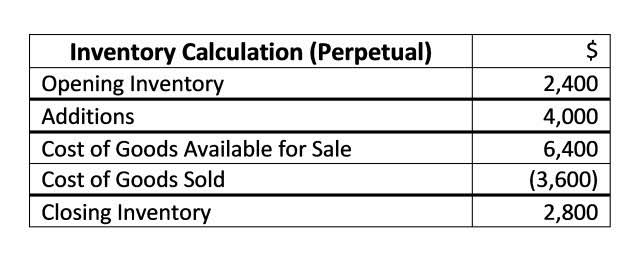

For example, reinvesting funds into business growth opportunities can reduce your taxes while expanding your business. And if you don’t, just know that your tax prep fees are tax deductible. Typically, business charitable contributions are not tax deductible, but they can be under certain circumstances. While the rules are straightforward, calculating cost of goods sold can be complex for some business owners.

Required Forms:

You can also deduct as much as 100% of the cost of social events held for your employees. American citizens with businesses based abroad can, under certain circumstances, leave the foreign income they’ve earned off their tax return. To qualify for the small business tax deductions exclusion, your tax home must be based abroad. This article can help you better understand the requirements for foreign-earned income exclusion. Our friends at Gusto put together a handy list of store deductions and startup tax deductions.

You are insured if you have the required number of credits (also called quarters https://www.bookstime.com/articles/how-to-find-an-accountant-for-small-business of coverage), discussed next. By not reporting all of it, you could cause your social security benefits to be lower when you retire.. Many tax professionals can electronically file paperless returns for their clients. Record the name and SSN of each employee exactly as they are shown on the employee’s social security card.